Mortgage loan | loan calculator | mortgage calculator

Mortgage loan is most searchable word on

most of the search engines. In this articles, we are going to discussed about

the mortgage loan, types of mortgage loan, benefits of mortgage loan, history

of mortgage loan, how to compare the mortgage loan, Why do people need Mortgage

loan, Can anybody get a Mortgage loan and many other topics you need. Keep

visiting jobspkrpl for the latest

articles.

What is mortgage?

A mortgage is a type of loan that is used

to purchase a property, such as a house or a piece of land. The borrower, or

the person who wants to buy the property, will typically apply for a mortgage

from a bank or other lending institution.

The mortgage is secured by the property

being purchased, which means that if the borrower fails to make their payments,

the lender has the right to take possession of the property and sell it to

recover the outstanding debt.

The mortgage loan is typically paid back

over a long period of time, such as 15 or 30 years, and includes both the

principal amount borrowed and the interest that accrues on the loan. The

interest rate on a mortgage can be either fixed or adjustable, meaning it may

stay the same over the life of the loan or change periodically based on market

conditions.

What is loan?

A loan is a type of financial transaction

where one party, typically a lender, provides money or assets to another party,

typically a borrower, with the expectation that the borrowed amount will be

paid back with interest over a specific period of time.

Loans can be used for various purposes,

such as purchasing a house, buying a car, starting a business, or covering

personal expenses. When a borrower applies for a loan, they typically must

provide information about their income, credit history, and other financial

details to help the lender assess the borrower's ability to repay the loan.

The terms of a loan can vary depending on

the type of loan, the lender, and the borrower's financial situation. For

example, loans may have a fixed or variable interest rate, require collateral

(such as a house or car) or be unsecured, and have different repayment

schedules or penalties for early repayment. In general, loans are a way for

individuals or businesses to access capital that they may not have immediately

available, with the expectation that they will pay back the borrowed amount

over time with interest.

What is mortgage loan?

A mortgage loan is a type of loan in

which a borrower pledges real estate as collateral in order to obtain funds for

purchasing property or refinancing an existing loan. The lender provides a

specific amount of money that the borrower is required to pay back with

interest over a set period of time, usually 15-30 years. The interest rate and

repayment terms are determined by the lender, based on various factors such as

the borrower's credit history and income. The property being mortgaged serves

as security for the loan, and the lender has the right to foreclose on the

property if the borrower fails to make payments.

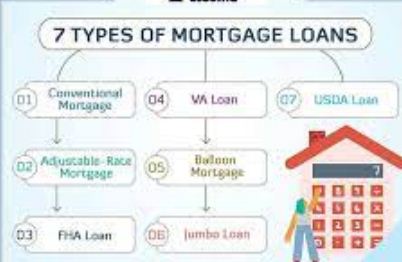

Kinds of Mortgage loan?

1. Fixed-rate mortgages: Fixed-rate mortgages are the most

popular type of mortgage. The interest rate remains constant for the life of

the loan, which is typically 15, 20, or 30 years.

2. Adjustable-rate mortgages (ARMs): With an ARM, the interest rate can change

over time, depending on various financial indices. ARMs typically offer lower

initial interest rates, but they can be more volatile over the life of the

loan.

3. FHA loans: Federal Housing Administration (FHA)

loans are government-backed mortgages that typically require a lower down

payment than conventional loans but may have higher interest rates.

4. VA loans: Veterans Affairs (VA) loans are

available to active-duty service members, veterans, and their families. They

offer low- or no-down-payment options with favorable terms.

5. Jumbo loans: Jumbo loans are intended for buyers who

are purchasing high-priced homes. They typically require excellent credit and a

significant down payment.

6. USDA loans: United States Department of Agriculture

(USDA) loans are designed to help people who want to purchase homes in rural

areas. They require no down payment and generally have low interest rates.

7. Bridge loans: Bridge loans are short-term loans

designed to help borrowers purchase a new home before selling their existing

home. They usually have higher interest rates and fees than traditional

mortgages.

8. Reverse mortgages: Reverse mortgages are available to

seniors age 62 and older who have significant equity in their homes. These

loans allow the borrower to receive a lump sum or monthly payment based on the

equity in their home, and the loan does not have to be repaid til the borrower

moves out or passes away.

9. Interest-only mortgages: With an interest-only mortgage,

borrowers pay only the interest on the loan for a fixed period (usually five to

ten years) before they begin paying off the principal. These loans can be risky

for buyers who do not have a solid plan for paying off the principal once the

interest-only period expires.

10. Balloon mortgages: Balloon mortgages are fixed-rate loans that require the borrower

to make small payments for several years (usually five to seven years) before

making a larger "balloon" payment to repay the remaining balance.

These loans can be risky because borrowers may not have the ability to make the

balloon payment when it is due.

History of Mortgage loan?

The history of mortgage loans dates back

to ancient civilizations such as Greece and Rome, where people had to put down

collateral to secure loans. The mortgage industry as we know it today, however,

began in the 1930s with the establishment of the Federal Housing Administration

(FHA) and the creation of government-sponsored mortgage entities such as Fannie

Mae and Freddie Mac.

Before the FHA was created during the

Great Depression, lenders typically required a 50% down payment for a home

loan, and the terms of the loan were short, often just 3-5 years. This made

homeownership unaffordable for most Americans.

The FHA was established in 1934 to help

stabilize the housing market and make it easier for people to obtain loans to

buy homes. The FHA insured mortgages, which meant that lenders were willing to

take a smaller down payment and offer longer repayment terms. This made

homeownership more accessible and affordable for many Americans.

In the 1970s, Fannie Mae and Freddie Mac

were created to buy up mortgages from lenders and sell them to investors,

freeing up more capital for lenders to make more loans. These

government-sponsored entities remain major players in the mortgage industry to

this day.

The mortgage industry has undergone

significant changes in recent years, with the introduction of new technologies,

tighter regulations, and changing consumer preferences. However, the basic

principle of a mortgage loan - using a home as collateral to secure financing -

remains the same.

Benefits of Mortgage loan?

Mortgage loans have several benefits,

including:

Access to Home Ownership: One of the primary benefits of a

mortgage loan is that it allows people to buy a home who may not be able to do

so otherwise. A mortgage loan provides you with the funds needed to purchase a

property and spread out payments over a longer period.

Lower Interest Rates: Mortgages typically have lower interest

rates compared to other forms of borrowing. This is because the loan is secured

against the property, which reduces the risk for the lender.

Tax Benefits: In many countries, homeowners can

deduct mortgage interest payments on their taxes, which can lower their overall

tax liability.

Build Equity: With each mortgage payment, you are

building equity in your home, which is the difference between the value of your

home and the amount you owe on your mortgage. Over time, as your equity grows,

you may be able to take out a home equity loan or line of credit to fund home

improvements or other expenses.

Predictable Payments: With a fixed-rate mortgage, your

monthly payment remains the same throughout the life of the loan, which can

make budgeting and planning easier.

Investment Opportunity: Real estate can be a good investment,

as property values tend to appreciate over time. By purchasing a home with a

mortgage, you can potentially benefit from the appreciation of your property.

Overall, a mortgage loan can be a

valuable tool for financing a home purchase and achieving the goal of home

ownership while also providing several financial benefits.

How Mortgage loan work?

A mortgage loan is a type of loan that is

used to purchase a property. Here's how it typically works:

Application: You start by applying for a mortgage

loan with a lender. The lender will evaluate your financial history, credit

score, income, and other factors to determine whether you qualify for a loan

and what the terms of the loan will be.

Down Payment: Once you're approved for a mortgage

loan, you'll need to make a down payment. This is a portion of the total cost

of the property that you pay upfront. The down payment is usually a percentage

of the purchase price, and the larger your down payment, the smaller your

mortgage loan will be.

Loan Amount: The lender will provide you with a loan

amount, which is the amount of money you can borrow to purchase the property.

This loan amount is based on the purchase price of the property, minus your

down payment.

Repayment: You will be required to repay the loan

over a set period of time, typically 15 to 30 years. The loan will include

interest, which is the cost of borrowing the money. Your monthly payment will

be based on the amount of the loan, the interest rate, and the length of the

loan.

Collateral: The mortgage loan is secured by the

property you're purchasing. If you fail to repay the loan, the lender can

foreclose on the property and sell it to recover the remaining balance of the

loan.

Closing: Once you've secured a mortgage loan,

you will close on the property. This involves signing legal documents, paying

closing costs, and transferring ownership of the property to you.

Overall, a mortgage loan is a long-term

financial commitment that allows you to purchase a property while spreading out

the cost over time. The loan is secured by the property, and failure to repay

the loan can result in foreclosure.

How to Compare Mortgage loan?

1. Interest rates: When comparing mortgages, the interest

rates are the most critical factor to consider, as they determine the total

amount you will pay for your loan. Check out the interest rates from different

lenders, and consider the one that offers you the best rate.

2. Loan term: The loan term is also essential in

determining your total costs. A shorter loan term means a higher monthly

payment but less interest paid over the loan's lifetime. A longer loan term

provides a smaller monthly payment but incurs more interest over the loan's

life. You may need to choose a term that fits your budget and financial goals.

3. Fees: Another factor is the fees charged by

the lender. These fees can include origination fees, appraisal fees, closing

costs, and more. Be sure to compare these fees from different lenders and

consider the total cost of the loan.

4. Flexibility: Look for a mortgage lender that offers

flexibility in features, such as principal payments, interest payments, or

repayment options. This can allow you to make extra payments, lower your

principal balance and reduce your overall interest expenses.

5. Reputation and Customer Service: Don't forget to

research the lender's reputation and past customer experiences. Check online

reviews, ask for referrals from friends and colleagues, and choose a lender

with excellent customer service to ensure a smooth and stress-free loan

process.

By comparing these factors, you can make

an informed decision about which mortgage loan is right for you.

Why do people need Mortgage loan?

People need a mortgage loan for a variety

of reasons, but the most common reason is to purchase a home. Here are some of

the reasons why people need a mortgage loan:

Homeownership: Most people don't have enough money to

purchase a home outright, so they need a mortgage loan to finance the purchase.

A mortgage loan allows them to spread out the cost of the home over a period of

years, making it more affordable.

Investment: Some people purchase property as an

investment, with the goal of either flipping the property for a profit or

renting it out to generate income. A mortgage loan can provide the necessary

funds to make the purchase and get the investment started.

Lower interest rates: Mortgage loans generally have lower

interest rates compared to other types of loans, such as personal loans or

credit cards. This is because the loan is secured by the property, which

reduces the risk for the lender.

Tax benefits: In many countries, homeowners can

deduct mortgage interest payments on their taxes, which can lower their overall

tax liability.

Building equity: With each mortgage payment, a homeowner

is building equity in their home. Equity is the difference between the value of

the home and the amount owed on the mortgage. Over time, as equity grows, a

homeowner may be able to take out a home equity loan or line of credit to fund

home improvements or other expenses.

Overall, a mortgage loan is a valuable

tool for anyone looking to purchase a home or invest in property. It allows

individuals to spread out the cost of a large purchase over a period of years,

while also providing several financial benefits such as tax deductions and the

opportunity to build equity.

Can anybody get a Mortgage loan?

Not everybody can get a mortgage loan, as

lenders have certain eligibility requirements that borrowers must meet. The

specific requirements can vary by lender, but here are some general factors

that lenders typically consider:

Credit

score: Lenders will review your credit score to

determine your creditworthiness. A higher credit score indicates that you're

more likely to repay the loan, and as a result, you may be eligible for lower

interest rates.

Income

and employment history: Lenders want to ensure that borrowers

have a stable source of income and employment. They may require proof of

employment and income, such as pay stubs or tax returns.

Debt-to-income

ratio: Lenders will evaluate your debt-to-income

ratio, which is the amount of debt you have compared to your income. A high

debt-to-income ratio can make it more difficult to qualify for a mortgage loan.

Down

payment: Most lenders require a down payment on the

property, typically ranging from 3% to 20% of the purchase price. The larger

the down payment, the more favorable the loan terms may be.

Property

appraisal: The lender will require an appraisal of the

property to ensure that it's worth the purchase price. If the property

appraises for less than the purchase price, the lender may not approve the loan.

Overall, getting approved for a mortgage loan

depends on meeting the lender's eligibility requirements, which can vary by

lender and individual circumstances. It's important to research different

lenders and loan options to find the best fit for your financial situation.

FAQ’s about mortgage loan

1. What

is a mortgage loan?

A mortgage loan is a type of loan offered by

lenders to help individuals purchase a home. The loan is secured by the

property being purchased, and the borrower must make payments, including

principal and interest, over time to pay back the loan.

2. What

are the different types of mortgage loans?

The main types of mortgage loans are fixed-rate

mortgages and adjustable-rate mortgages. Fixed-rate mortgages have a fixed

interest rate for the entire loan term, while adjustable-rate mortgages have a

variable interest rate that can change over time.

3. What

are the requirements for getting a mortgage loan?

The requirements for obtaining a mortgage loan

vary by lender, but typically include a good credit score, stable employment,

and enough income to make the monthly payments on the loan.

4. How

much can I borrow with a mortgage loan?

The amount you can borrow with a mortgage loan

depends on several factors, including your income, credit score, and the value

of the property you are purchasing.

5. How

long does it take to get approved for a mortgage loan?

The process of getting approved for a mortgage

loan can take anywhere from a few days to several weeks, depending on the

lender and the complexity of the application.

6. What

is the process for obtaining a mortgage loan?

The process of obtaining a mortgage loan

typically involves filling out an application, providing documentation of

income and assets, and going through a credit check. After approval, you will

work with the lender to finalize the terms of the loan and complete the closing

process.

7. What

is a down payment?

A down payment is an upfront payment made by

the borrower at the time of closing on a home. The down payment is typically a

percentage of the total cost of the home and can range from 3% to 20% or more.

8. What

is mortgage insurance?

Mortgage insurance is a type of insurance

required by the lender to protect them in the event that the borrower defaults

on the loan. There are different types of mortgage insurance; including private

mortgage insurance (PMI) and FHA mortgage insurance.

mortgage loan calculator

Related Articles

- AllstateComprehensive Insurance Coverage: What It Covers

- Metromile Insurance Claims and phone number

- Kin Insurance Florida: The Pros and Cons

- Everything You Need to Know About Debt Consolidation loan

- American Mortgage Consultants News What It Is and How It Works

- homeloan calculator | what is homeloan

- What isF1 formula 1 news for f1